ETH Plummets Post-Merge as DeFi Chugs Along

Ether Is Down Nearly 10% In The Past 24 Hours

By: Owen Fernau 18 hours ago

Maybe the Merge was a sell-the-news event after all.

ETH has fallen just under 10% in the past 24 hours, while Bitcoin, the world’s largest cryptocurrency, has only dropped 2%. The DeFi Pulse Index (DPI), the largest index focused on DeFi, is down 6%.

Ether’s relatively large drop isn’t surprising considering an Aug. 8 report by Glassnode, which noted that both futures and options for ETH were in backwardation post-September.

Backwardation occurs when the spot price of an asset is above its price in the futures market and indicates that the majority of investors expect prices to drop.

Business As Usual

Still, veterans of the space are rejoicing in the Merge’s wake, which appears to have broadly gone off without a hitch.

Amir Bandeali, the co-founder of 0x Labs, told The Defiant that the 0x protocol encountered no issues post-Merge. 0x launched in 2017 and underpins the Matcha DEX aggregator, which has facilitated $49B in trading volume since inception, according to a Dune Analytics dashboard.

“As one of the earliest projects to launch on Ethereum, we’re ecstatic that the Merge was successful,” Bandeali said. “We look forward to seeing the ecosystem benefit from a stronger technical foundation and greater energy efficiency.”

ETH Borrow Rates Normalize

Borrow rates on DeFi lender Aave have returned to the 2% range after spiking to over 180% on Sep. 14 as traders positioned themselves ahead of the Merge to receive ETHPoW, the native asset of the Ethereum proof-of-work chain.

“[It’s] surprising how fast all the rates came down,” Pedro Negron, research analyst at Into The Block, a crypto analytics and research firm, told The Defiant.

The Ethereum proof-of-work chain is the result of the Merge, which left behind a blockchain running on Ethereum’s old consensus mechanism. Holders of ETH received ETHPoW equivalent to their ETH balance at the time of the Merge, leading to the rush to own as much of the digital asset as possible at the time of the upgrade.

Interest rates on Euler Finance, another lender with $253M in total value locked (TVL) according to DeFi Llama, also surged and fell with the rate of utilization. Lenders like Euler are designed to increase interest rates when demand for an asset is high, partially to incentivize repayment of outstanding loans.

Seraphim Czecker, head of risk at Euler Finance, told The Defiant that the protocol saw one user who had been borrowing and short-selling ETH against a wrapped staked ETH (stETH) position, withdraw $46M of stETH as interest rates on the platform skyrocketed.

It’s not clear whether the depositor withdrew because the interest rate, which hit 100% on ETH, was too high or because they simply wanted to get the ETHPoW airdrop.

Regardless, the depositor has since reentered the leveraged stETH position as ETH borrowing rates have dropped to 10% as of Sep. 15, according to Czecker.

stETH Rally

stETH has moved further towards parity with ETH after the Merge, according to a Dune Analytics dashboard.

Trading volume in the ETH-stETH pool on Curve Finance, DeFi’s second-largest exchange with just over $5B in total value locked (TVL), hit a three-month high, according to Into The Block’s Negron.

Negron thinks a possible reason people are trading back into stETH is that, like Aave and Euler borrowers, they wanted vanilla ETH to get ETHPoW. Having achieved that, traders can move back into stETH positions to continue collecting proof-of-stake yield.

Additionally, staking yields are supposed to increase post-Merge, added Negron. This gives users another reason to hold stETH as opposed to ETH.

Plus, the successful Merge has somewhat reduced the uncertainty related to staking, which may also have made stETH more attractive relative to ETH.

Indeed, Mika Honkasalo, previously an investor at investment firm ParaFi Capital, thinks staking derivatives may usurp ETH as the primary asset in the DeFi and NFT ecosystems.

In all, the Merge has caused some predictable reshuffling in DeFi, but those changes largely appear to be a return to normalcy after the rush for ETHPoW came to an end.

And more importantly, nothing appears to have broken.

“It was not as crazy as we expected,” Czecker said. “That’s good though.”

Bitcoin just had its worst month on record

- Bitcoin just finished its worst month in the 12 years that it’s been available

- on exchanges, losing more than 38% of its value in June as of Thursday

- afternoon.

- Ether, the world’s second-biggest cryptocurrency by market capitalization,

- ended the same period down by about 47%.

Bitcoin just finished its worst month on record, losing more than 38% of its value in June, as of

Thursday afternoon. Ether, the world’s second-biggest cryptocurrency by market capitalization,

ended the same period down by about 47%.

Though weakness in the digital assets sector is part of a broader flight from risk, confidence in

the crypto market, in particular, has been rocked in recent weeks as major companies face

solvency crises.

In May, the popular U.S. dollar-pegged stablecoin project UST — and its sister token luna —

imploded, tallying a $60 billion collective loss. Then in early June, lending firm Celsius, which

promised users high yields for their digital currency deposits, paused withdrawals for customers, citing “extreme market conditions.”

Elsewhere, prominent crypto hedge fund Three Arrows Capital defaulted on a loan worth more

than $670 million on Monday. And on Thursday, sources told CNBC that FTX plans to buy

crypto lender BlockFi for $25 million. That’s 99% below BlockFi’s last private valuation,

effectively “wiping out” the company’s equity investors, according to one source.

All this comes amid industrywide layoffs at major crypto firms, including Coinbase, whose

stock fell about 40% in June, marking its fourth straight negative month.

“There is still an aspect in crypto that we are waiting to see if another shoe will drop, if another

entity will fail, if the credit cascade will continue,” said Matt Hougan, chief investment officer

at Bitwise Asset Management, in an interview. “I think we have to get through the Fourth of July weekend and get through that quiet period in the market before we build in the second half of the year.”

To some degree, extreme volatility is the price of doing business in the digital asset market.

In the last decade, bitcoin has experienced two prolonged periods of depressed prices before it rebounded. In the previous crypto winter in 2018, bitcoin lost more than 80% of its value before bouncing back, eventually rising to its November 2021 peak of around $69,000.

But a note from Bank of America on Wednesday struck a pessimistic tone. Analysts pointed to

data indicating that U.S. consumers are more wary of the crypto market. Internal customer

data shows a more than 50% decline in the number of active crypto users from its peak of over 1 million users in November 2021 to less than 500,000 in May, the bank said.

The drop in June was the worst for the cryptocurrency since it was first made available on

exchanges in 2010. More than $2 trillion in value has been erased from the crypto markets in a matter of months, punishing retail traders who bet big on crypto projects that were billed as safe investments.

The crypto market’s sub-$1 trillion market cap is tiny compared to the country’s $21 trillion GDP or $43 trillion housing market. But U.S. households own one-third of the global crypto market, according to estimates from Goldman Sachs. A Pew Research Center survey also found that 16% of U.S. adults said they had invested in, traded or used a cryptocurrency.

Still, many bitcoin enthusiasts expect another revival, and are buying at what they anticipate

will be record lows. Michael Saylor tweeted on Wednesday that MicroStrategy snapped up an

additional 480 bitcoin for about $10 million, bringing the company’s total holdings of the world’s

most popular digital coin to around $4 billion.

“If your timeframe is a week, or a month, or even a quarter, I think there’s still significant

volatility,” said Hougan. “If you have a time horizon measured in years, then yes, this is a great

opportunity to think about entering the market.”

====================================================================

Tensions rise as Bitcoin price reconquers $31,000, is the sell-off over?

- Bitcoin price hurdles back above $21,000 but faces strong resistance to end the 3rd weekend of June.

- BTC price still consolidates beneath the 200-Week Moving Average.

- A safe invalidation of the bearish downtrend is a breach above $32,500.

Bitcoin price sees turbulence

Bitcoin price is facing significant resistance to stay above the reconquered $31,000 level it managed to hurdle over the weekend. Now, the bears are coming out to place their bets as the bulls are progressively losing momentum. If market conditions persist, a break below $31,000 could trigger a volatility-induced sell-off as the investors’ market sentiment seems proportionally divided.

Bitcoin price, as of Today, June 26 2022, trades at $31,400. The bulls have managed to recover 20% of losses since the June 18 sell-off. However, throughout the weekend, the momentum has begun stalling, which is visible in the sideways price action between $29,700 and the current price. Traders may be sitting on the sidelines as the BTC price has yet to retrace into the 200-Week Moving Average.

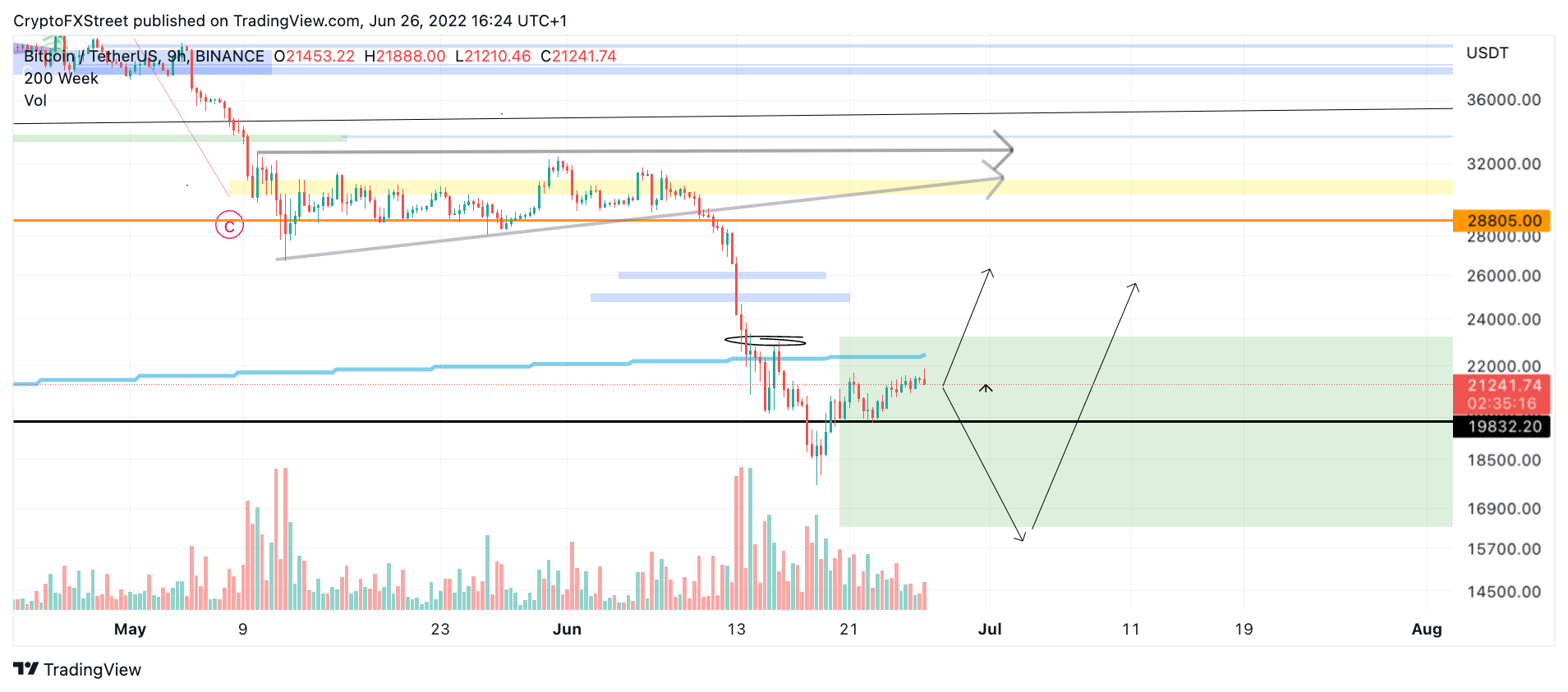

BTC/USDT 9-Hour Chart

Traders looking to partake in a move should switch to a five and fifteen-minute chart as tight ranges tend to resolve in highly erratic impulsive waves in either direction. A breach above the 200-Week moving average could propel the bitcoin price towards $25,130 as early as Monday, June 27.

Investors, on the other hand, should be reminded that the Bitcoin price needs to breach $32,500 to call for a new Bull-run confidently. If $32,500 is breached, there will be plenty of opportunities in the future to join the uptrend rally targeting $80,000 and above, resulting in more than a 275% increase from the current Bitcoin price.

0 Comments